Search Properties, Hotels and Professionals

Agricultural

Airplane Hangers

Automotive

Biotechnology

Bowling Alleys

Business Parks

Business Property

Casinos

Cemetery

Churches

Cold Storage Facilites

Community and Neighborhood Centers

Condemnation compensation

Conservation Easements

Data Centers

Development and Construction

Eminent Domain

Expert Witness

Farmland

Feasibility Studies

Financial Reporting

Fitness Clubs

Flex R and D

Forest/Timberland

Golf Courses

Green Buildings

High Tech

Hospitals

Indian Reservations

Industrial

Judicial Arbitration

Land

Lease up Studies

Leasehold interests

Malls

Manufacturing Units

Marinas

Market Analysis

Mediation Services

Medical Clinics

Military

Mining

Motels

Multifamily

Neutral Arbitrator

Nursing Homes

Office Buildings

Parking Lots

Parks

Apartments / Flat - Highrise

Condominiums

home

Hud subsidized Housing

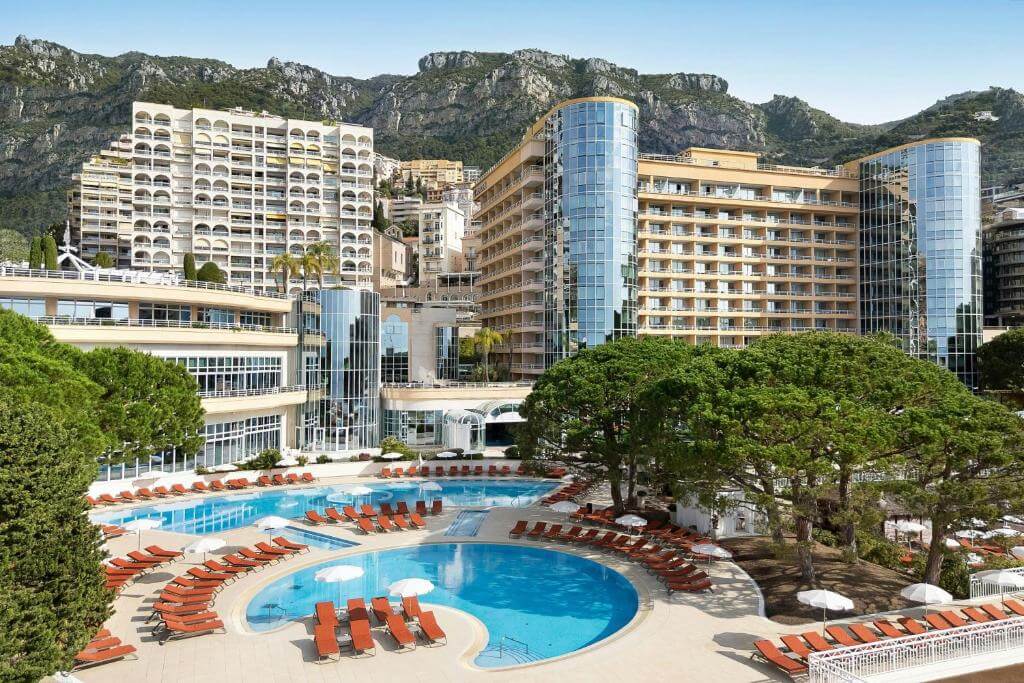

Lodging Properties

Mixed Use

Mobile Homes

Villa

Convention Hotels

Hotel

Hotels

Hotels and Resorts

Property Categories

Trending Properties

Why Choose Us Edit

Verified Listings Edit

All our properties are thoroughly verified for authenticity and quality

Verified Listings Edit

All our properties are thoroughly verified for authenticity and quality

Verified Listings Edit

All our properties are thoroughly verified for authenticity and quality

Insigths & Inspiration for Your Next Property

Explore the latest trends, tips, and guides to make informed decisions.